Slow Job Growth Understates Bay Area Economic Strength

August 23, 2021

The Bay Area posted modest but disappointing job gains since March. At the same time VC funding is strong, people are reentering the workforce and housing permits have begun to rebound. The U.S. economic outlook and federal policies have improved with positive implications for our region. The Bay Area still faces challenges in housing and other areas that affect our economic competitiveness and, in doing so, reduce our ability to meet equity and environmental goals.

The highlights:

• The Bay Area added 119,300 jobs between January and July 2021 and the regional unemployment rate fell from 6.6% to 5.7%. Job gains were led by the San Francisco and San Jose metro areas and a rebound in the restaurant and tourist sectors.

• The U.S, and Bay Area economic outlook has been upgraded by the $1.9 billion COVID relief package, the likely passage of a major infrastructure package, and positive movement on the safety net and environmental investments and the possibility of more favorable immigration policies that all play to Bay Area strengths.

• The long-term Bay Area economic challenges remain with only slow progress on housing, transportation and economic competitiveness, challenges at the front of the Bay Area Council policy agenda.

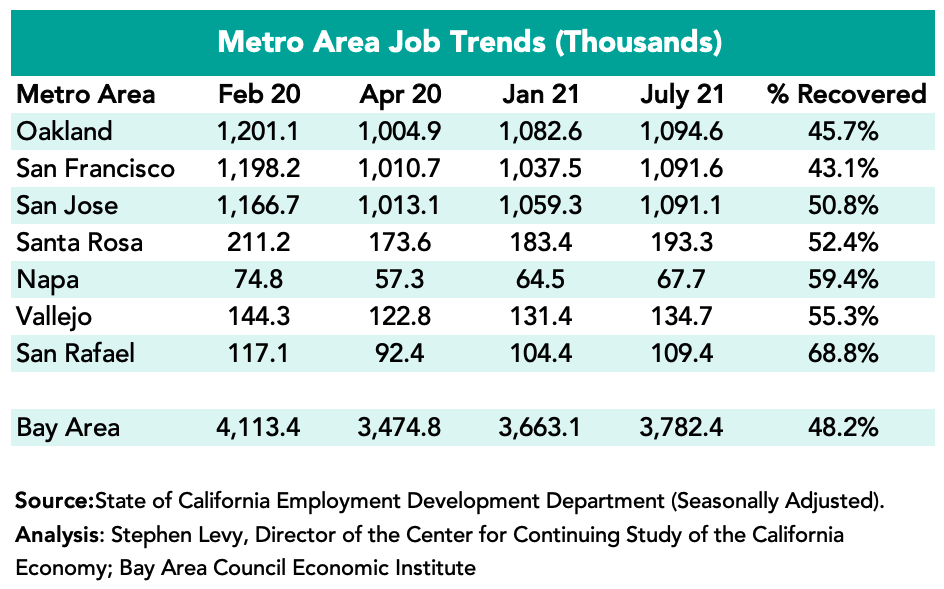

Job Growth is Steady but Disappointing Compared to the Nation

The Bay Area added 119,300 jobs since January 2021 led by a gain of 54,100 in the San Francisco metro area though SF has recovered just 43.1% of the jobs lost between February and April 2020 as job gains are offset by companies moving jobs out of SF. The San Jose metro area added 31,800 jobs but by July had recovered only 50.8% of the jobs lost between February and April 2020. The Napa and San Rafael metro areas had the largest % job recovery by July 2021.

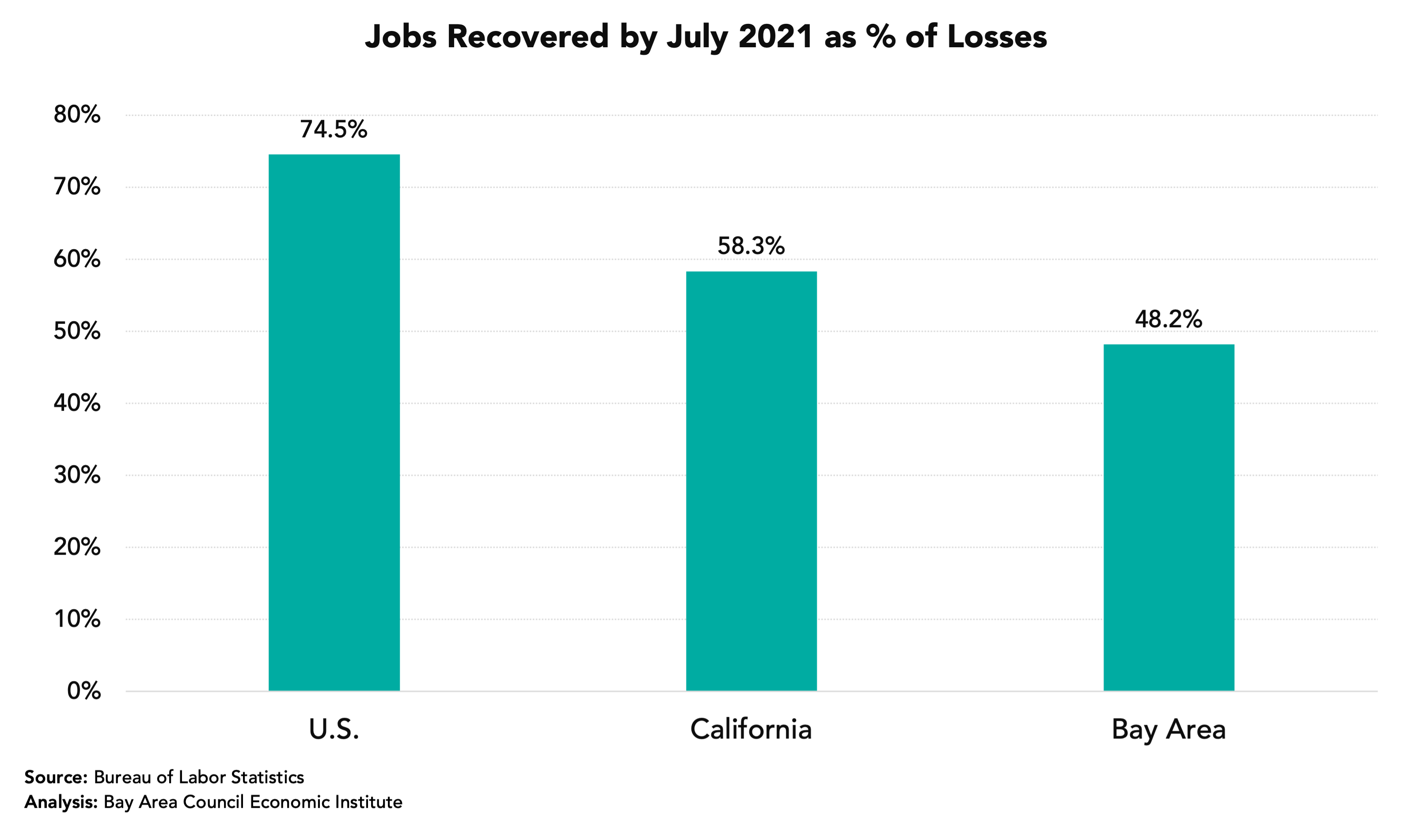

The Bay Area Had Recovered Just 48.2% of Lost Jobs by July 2021 Yet VC Funding is Surging and Residents Are Rejoining the Workforce

In July 2021 the Bay Area had recovered 48.2% of the jobs lost between February and April 2020 up from 29.4% in January. The state had recovered 58.3% up from 34.0% while the nation had recovered 74.5% of lost jobs up from 55.4%. At the same time VC funding in Q1 2021 was $24.4 billion, the second highest quarter in record and 40% of a record $62 billion nationally.

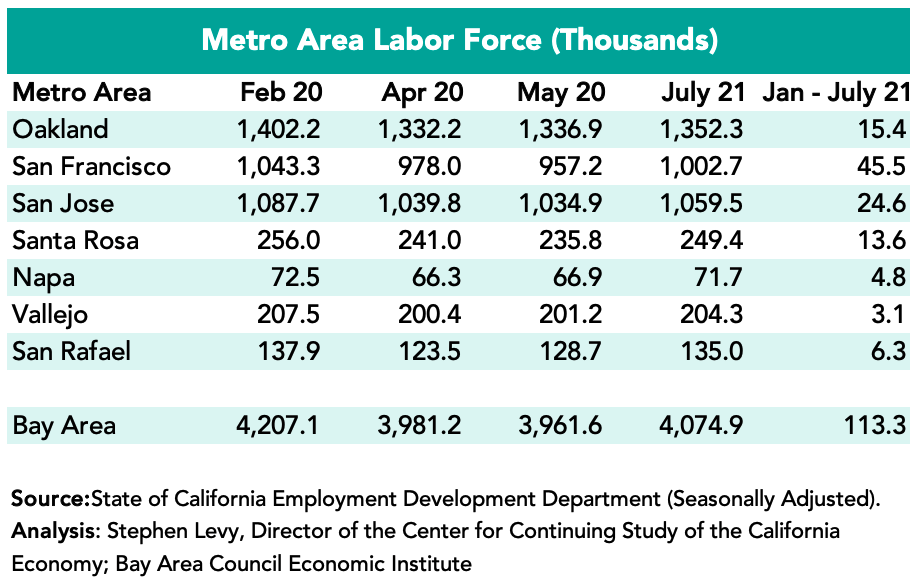

Since January 113,300 residents have rejoined the labor force in the Bay Area with the largest gains in the SF and SJ metro areas. There is more catch up to do and we should see more gains when the September and October data that reflect school openings and, possibly, the end of extra UE benefits come out.

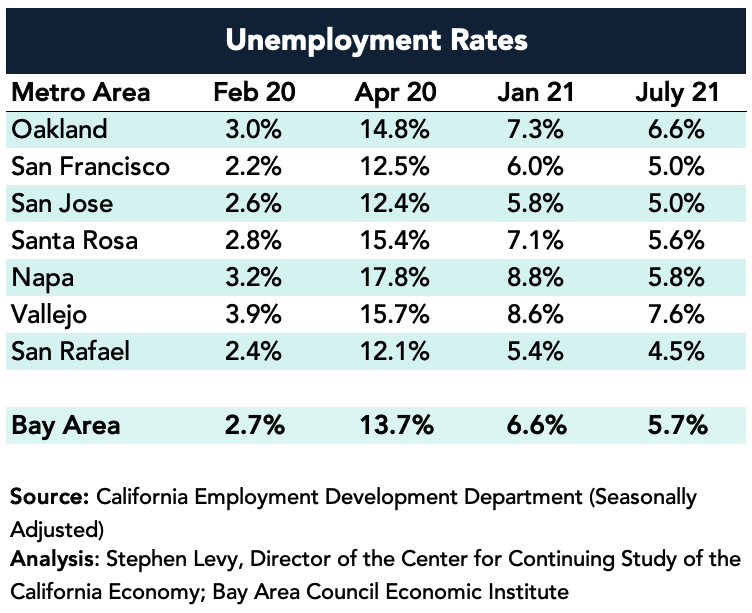

Unemployment Rates Rose to 5.7% in the Region in July 2021 from 5.4% in May 2021.

The lowest rates were in the San Rafael metro area (4.5%) followed by the San Francisco and San Jose metro areas in July 2021. Unemployment rates jump in the summer months and then fall in September normally. Bay area rates are well below the state 7.6% UE rate.

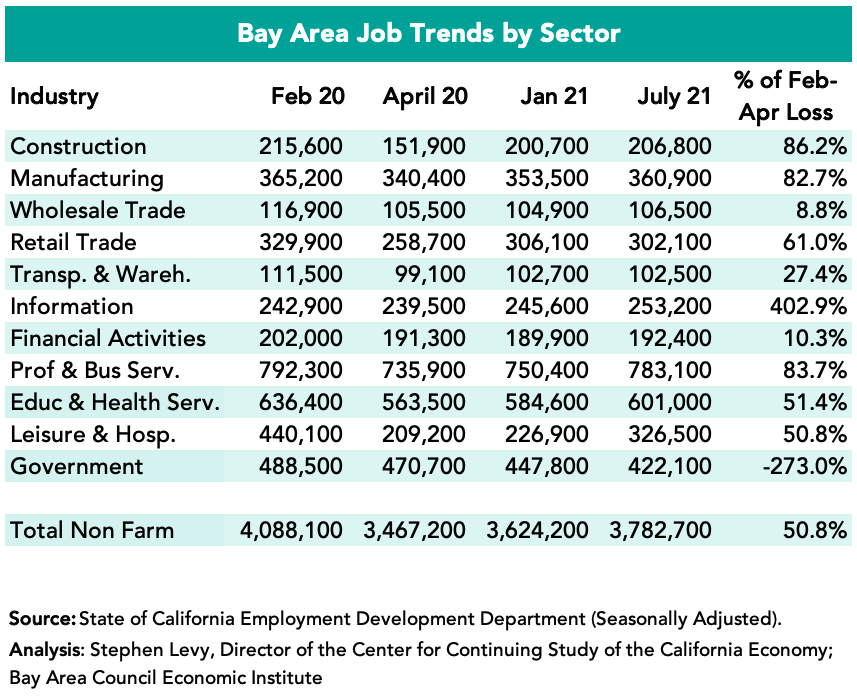

Industries Were Affected Differently

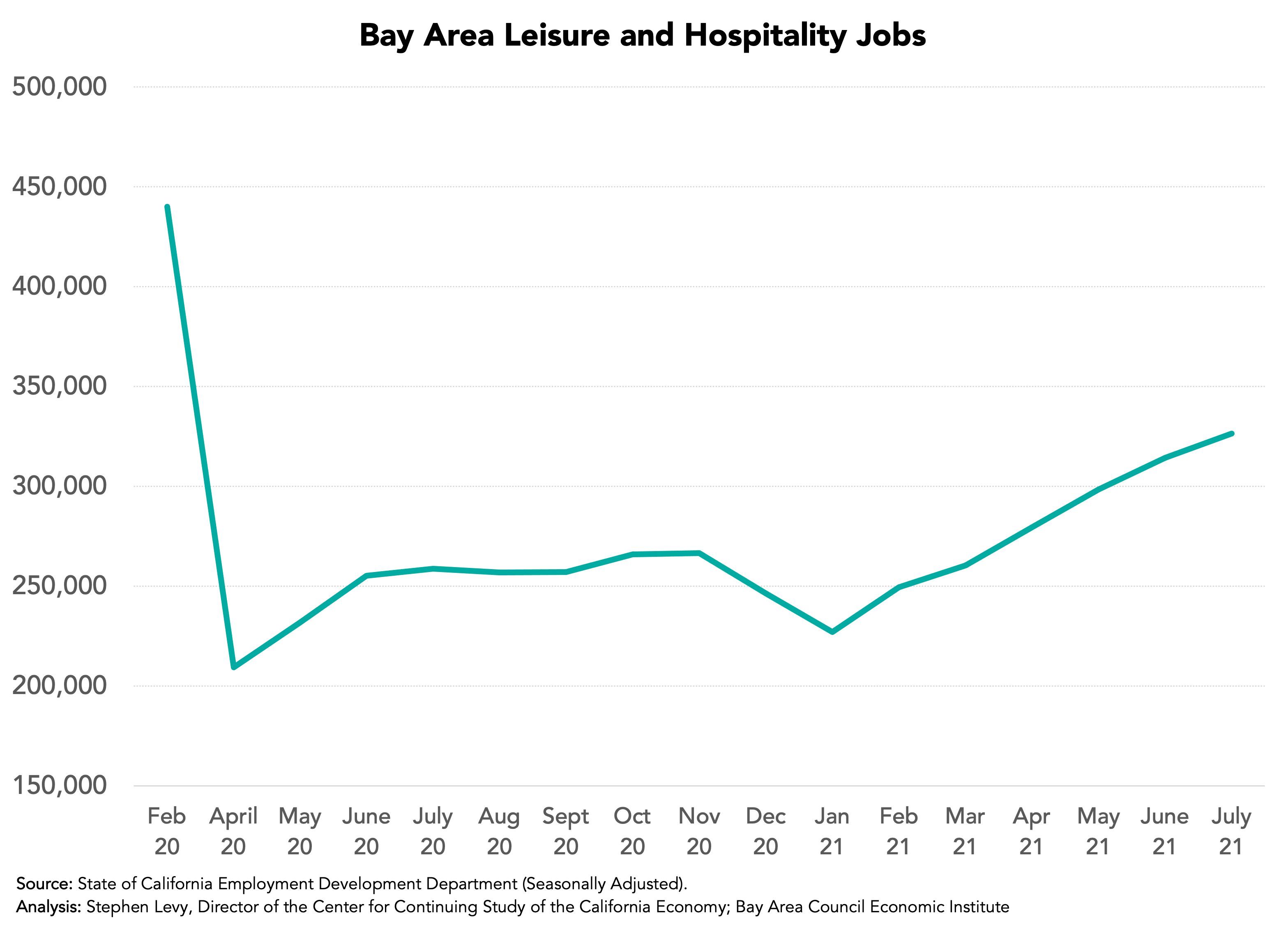

The Information sector actually added a small number of jobs compared to before the pandemic hit. On the other hand, the Leisure and Hospitality sector recovered only 50.8% of lost jobs by July 2021 though strong gains were posted these in the past six months. The Government sector has fewer jobs now than in April 2020. The Construction, Professional and Business Services and Manufacturing sectors have recovered most of the jobs between February and April 2020.

The Leisure and Hospitality Sector Took the Biggest Hit but is Now Recovering

Restaurant job gains have fueled recent regional job growth and now tourist and sports activities are reopening, which should lead to further job recovery if enough workers can be found.

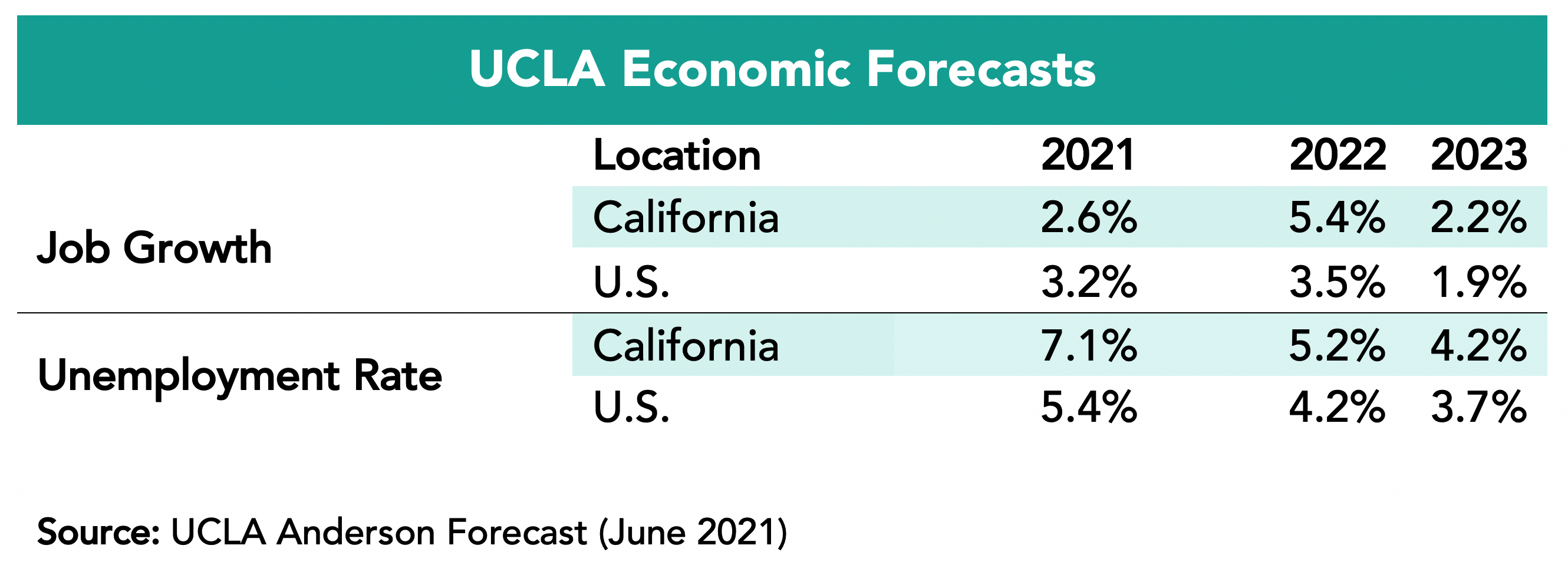

The Look from June 2021

Several factors point to a better economic outlook for the Bay Area. The UCLA June 2021 forecast has the state outpacing the nation in job growth for the next two years led by the Bay Area economy. The recently passed COVID relief package ($1.9 trillion), the new policies on immigration, trade and infrastructure all support the region and state economies.

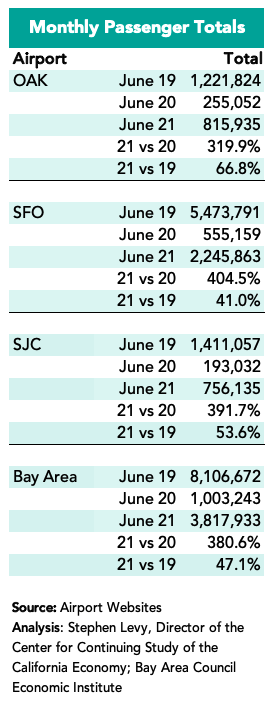

Airline Passenger Count Up, But Still Far Behind 2019 Levels

Airline passenger counts picked up in April at all Bay Area airports. However, Bay Area passenger counts in June 2021 were just under 1/2 of comparable month 2019 totals.

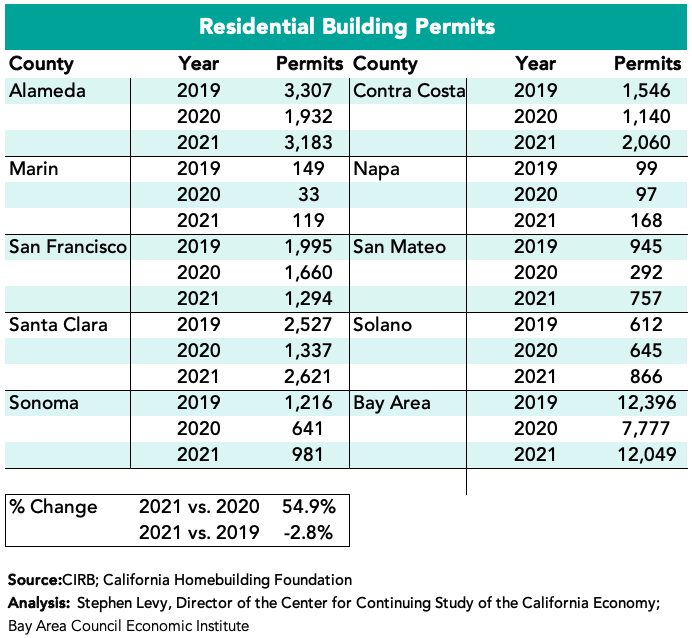

Housing Permits Up Over 2020 Levels, Trail 2019 Slightly

Housing permit levels are up over 2020 in the first six months of 2021 but still slightly trail 2019 comparable months.

Large Challenges Remain

Yet, the Bay Area Council warnings about losing our competitiveness remain as housing and mobility challenges are far from solved—the major causes of recent movements of companies and residents.

The rebound from pandemic related economic losses will continue but new policies are needed to maintain and improve the long-term competitiveness of the Bay Area economy.